There is no SILENCE; but the voice is UNHEARD. This blog aims to update the social and legal views of the blogger. Mail: sherryjthomas@gmail.com Call @ 9447200500 www.sherrylegal.in

Search This Blog

Tuesday, December 23, 2014

Wednesday, December 17, 2014

DCRG cannot be attached/recovered from the employees of KSRTC - surety-loan transaction- Kerala High Court Judgment.

Unnikrishnan Nair V. KSRTC

2014(4) KHC 803

The Petitioner is a retired employee of KSRTC. He stood as surety for a co-worker towards the loan transaction. When the principal debtor defaulted, the authorities proceeded against him and tried to recovered it from the DCRG.

Reliance place on Kunjumuhammed V. KSFE 2009 4 KHC 185- which says even if a surety agrees to recover the amount out of gratuity, such an agreement is not enforcible since the amount of gratuity is made free from any attachments.

But the authorities contented that it will be sufficient compliance of the requirement stipulated in Ruling NO.1 attached to Rule 3 of Part III of KSR, authorising recovery. Therefore, the attachment made on amount of DCRG is in order.

In Kunjumohammed's case court found that section 13 of Payment of Gratuity Act 1972 provides that gratuity payable under Act is not liable to be attached in execution of any decree or order of any civil court, revenue court or criminal court. It is provided under section 14 of the Act that provisions of the Act or any rules made thereunder shall have overriding effect notwithstanding anything contained inconsistent thereto in any other enactment or instrument of contract.

FACT Ltd V. Sebastian k John 2013 KHC 3705 held that gratuity can be forfeited only if the conditions enumerated under section 4(6) of the Act is satisfied.

Insurance company directed to pay compensation - Senior Citizens Red Carpet policy - Star Health Insurance Company.

The insurance form was filled up by the agent of Insurance Company. The insured contented that he had given all the details of the existing diseases; but the agent filled according to his will. The insured only signed the document.

The Permanent Lok Adalath Ernakulam Bench held that, the onus to prove that there is suppression from the part of insured while filling up the application form is on the part of the Insurance Company. It was also held that, the Insurance company has to prove that the suppression is with fraudulent intention. D Pappachan chaired the Bench.

Judgment - Permanent Lok Adalath

The Permanent Lok Adalath Ernakulam Bench held that, the onus to prove that there is suppression from the part of insured while filling up the application form is on the part of the Insurance Company. It was also held that, the Insurance company has to prove that the suppression is with fraudulent intention. D Pappachan chaired the Bench.

Judgment - Permanent Lok Adalath

Saturday, December 6, 2014

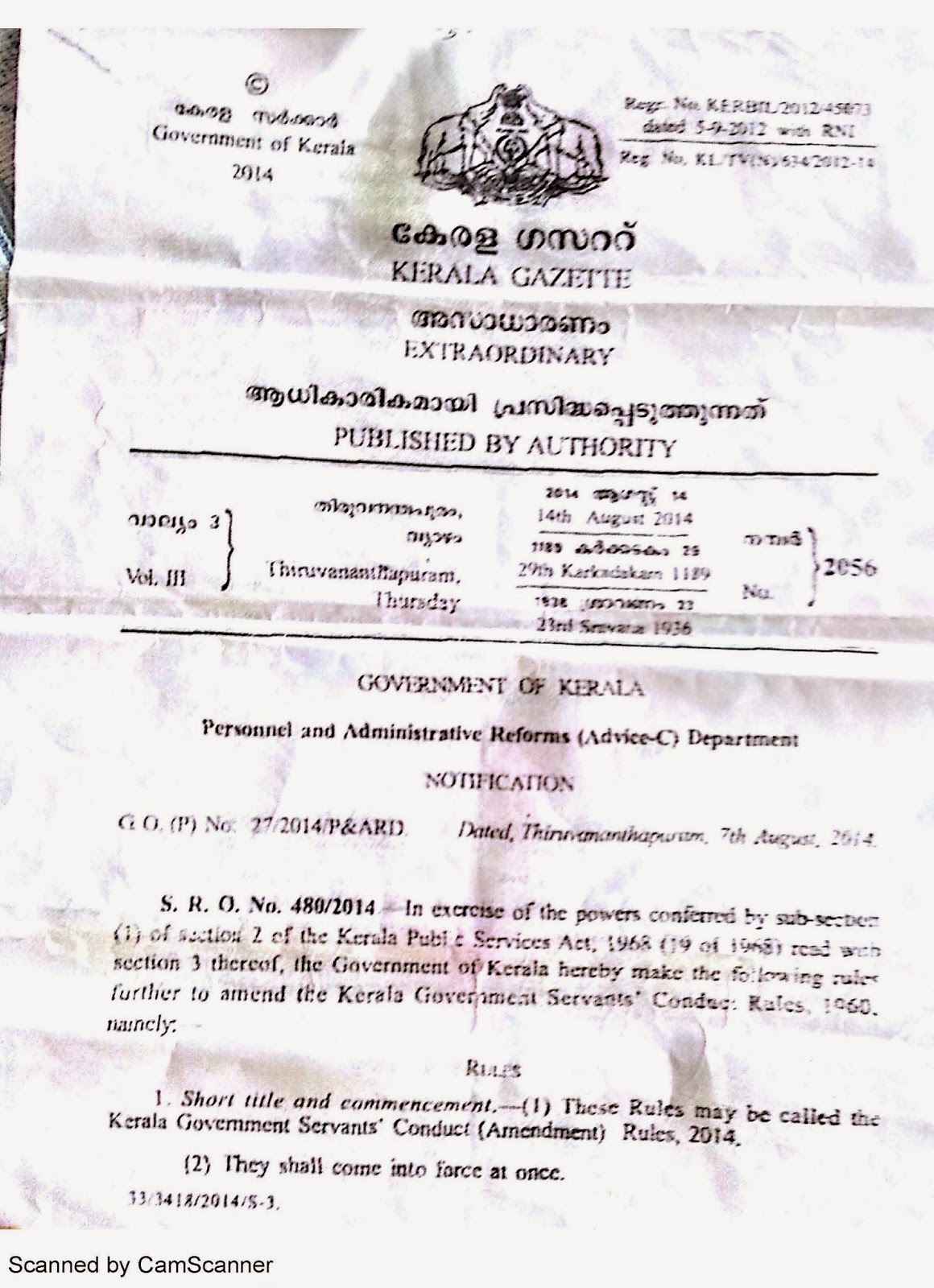

KERALA GOVERNMENT SERVANTS CONDUCT (AMENDMENT) RULES 2014 - BAN ON TAKING PART IN COMMUNAL OR RELIGIOUS ACTIVITY

The new amendment (2014) in Kerala Government Servants Conduct Rules forced to raise the eye brows of many if the amendment is read at a glance. The plain reading of the Rule 67A says taking part in communal or religious activities are banned. Whereas, the explanatory note which does not form the part of the notification airs a meaning that, taking part in activities which involve collection of money from public, persons or private entities are the legislative intention behind the amendment.

Subscribe to:

Posts (Atom)